-

- International (ENG)

Trade on popular cryptocurrencies with leverage, from bitcoin and ethereum to TRON and NEO, on our award-winning

spread betting and

CFD platform. With tight spreads, lightning-fast execution and the highest customer satisfaction in the industry.*

Start trading on cryptos

Precision pricing

We aggregate pricing from 18 different feeds to get you a more accurate price.

Minimal slippage

With fully automated, lightning-fast execution in 0.0045 seconds**.

99.9% fill rate^

No partial fills or manual dealer intervention, regardless of your trading size.

Dedicated customer service

UK based, award-winning service 24/5, whenever you're trading.

Crypto indices

Take a view across our full range, top or emerging cryptocurrencies with a single trade.

Tax-free trading

Pay no capital gains tax on profits from cryptocurrency spread bets†.

Get exposure to volatility on favourites like bitcoin and ethereum, as well as alt coins like polygon with spreads from as low as 0.65 points.

Pricing is indicative. Past performance is not a reliable indicator of future results.

Whatever you trade, costs matter. We’re committed to keeping our costs as competitive and transparent as possible, whether you trade CFDs on bitcoin, ethereum or our cryptocurrency indices.

Expecting big things from crypto? We’ve grouped different cryptocurrencies together in order to create three new crypto baskets, allowing you to trade on multiple cryptos with a single position.

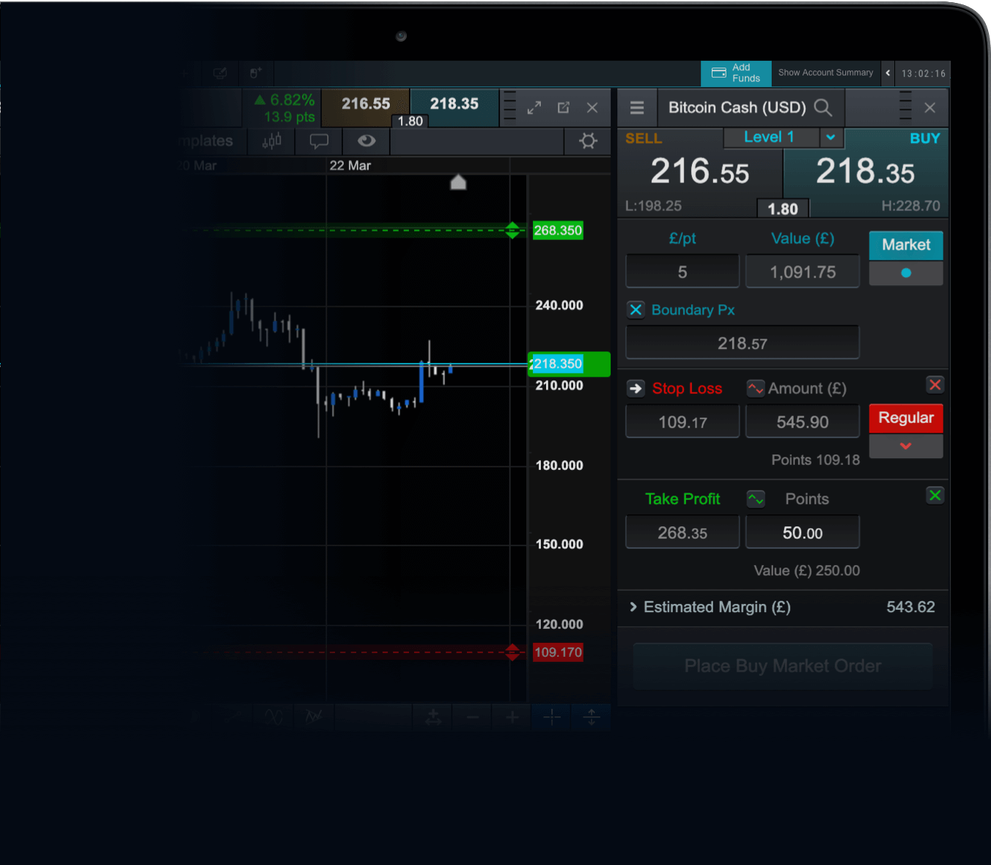

Fast execution, exclusive insights and accurate signals are vital to your success as a cryptocurrency trader. Our award-winning trading platform was built with the successful trader in mind.

Advanced order execution

We offer a range of advanced order types, including trailing and guaranteed stop losses, partial closure, market orders and boundary orders on every trade, so you have the flexibility to trade your way.

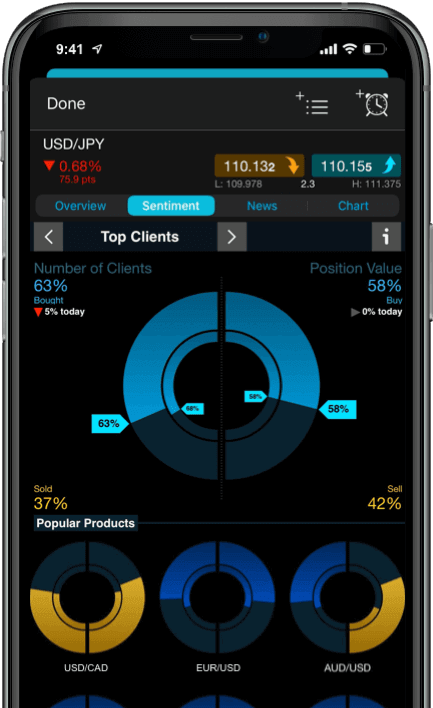

Client sentiment

Our client sentiment tool shows you where the market is bullish and where it’s bearish, based on real-time trades. Identify trends based on how that sentiment changes over time across our whole client base or just our top traders.

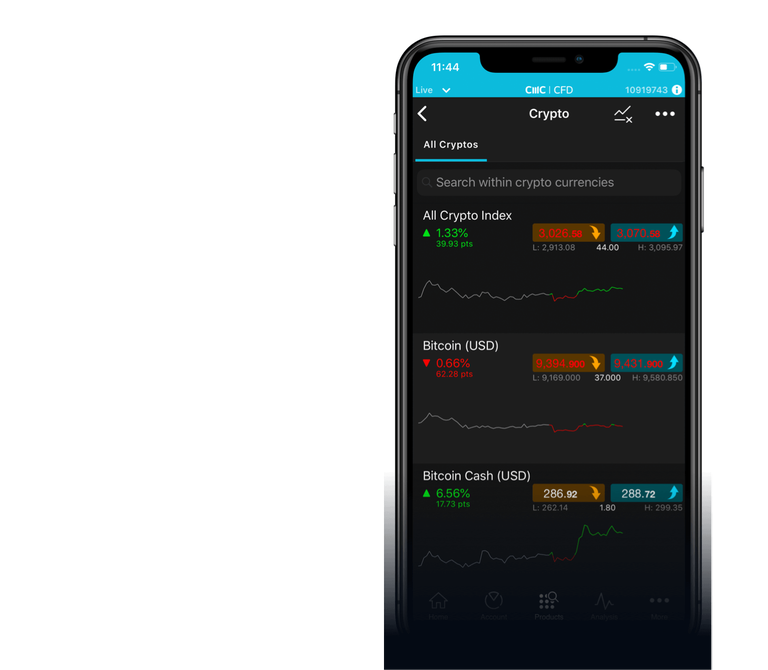

Award-winning app*

Industry-leading charting

Best Platform Features

Investment Trends 2013-2019 UK Leverage Trading Report

Highest Overall Customer Satisfaction

Investment Trends 2013-2019 UK Leverage Trading Report

Best Mobile/Tablet App

Investment Trends 2013-2019 UK Leverage Trading Report

Jack Schwager, renowned author of the Market Wizards book series, reveals a major misconception in investing.

Trade like you’re on a desktop, on your mobile. Our award-winning mobile trading app allows you to seamlessly open and close trades, track your positions, set-up notifications and analyse mobile optimised charts.

Is it free to open an account?

There's no cost when opening a live spread betting or CFD trading account. You can also view prices and use tools such as charts, Reuters news or Morningstar quantitative equity reports, free of charge. However, you will need to deposit funds in your account to place a trade. You can find out more about the costs of placing a trade here

Is ALFATRADING-MARKETS regulated by the FCA?

Yes, Address: plc (registration number 173730) and CMC Spreadbet plc (registration number 170627) are fully authorised and regulated by the Financial Conduct Authority (FCA) in the UK. Retail client money is held in segregated client bank accounts and money held on behalf of clients is distributed across a range of major banks, which are regularly assessed against our risk criteria.

Is ALFATRADING-MARKETS covered by the FSCS?

Yes, your eligible deposits with ALFATRADING-MARKETS are protected up to a total of £85,000 by the Financial Services Compensations Scheme (FSCS), the UK's deposit guarantee scheme. If ALFATRADING-MARKETS ever went into liquidation, retail clients would have their share of segregated money returned, minus the administrator's costs in handling and distributing these funds. Any shortfall of funds up to £85,000 may be compensated under the FSCS.

How does ALFATRADING-MARKETS protect my money?

As a CMC client, your money is held separately from ALFATRADING-MARKETS' own funds, so that under property, trust and insolvency law, your money is protected. Therefore your money is unavailable to general creditors of the firm, if the firm fails.

How does ALFATRADING-MARKETS make money?

Our income primarily comes from our spreads, while other fees, such as overnight holding costs, make a minor contribution to our overall revenue.

We never aim to profit from our clients' losses. Our aim is to build long-term relationships by providing the best possible trading experience through our technology and customer service.

What is a cryptocurrency?

A cryptocurrency is a type of digital money created from code. They function autonomously, outside of traditional banking and government systems.

Find out more

How to trade cryptocurrencies with ALFATRADING-MARKETS

Cryptocurrency trading is the process of speculating on a digital currency’s price movements. Exposure to cryptocurrencies’ price movements can be achieved without owning the asset via a spread betting or CFD trading account, or can be bought and sold on crypto exchanges.

See our cryptocurrency trade examples.

What are the costs involved in trading on cryptocurrencies?

There are a number of costs to consider when spread betting or trading CFDs on cryptocurrencies, including spread costs, holding costs (for trades held overnight – this is essentially a fee for the funds we ‘lend you’ to cover the leveraged portion of the trade) and guaranteed stop-loss order charges (if you use this risk-management tool).

Learn more

What is leveraged trading?

One of the advantages of spread betting and trading CFDs is that you only need to deposit a percentage of the full value of your position to open a trade, known as trading on leverage. Remember, trading on leverage can amplify profits and losses, so it’s important to manage your risk.

Why spread betting?

Spread betting allows you to trade tax-free on a wide range of financial markets 24 hours a day, from Sunday night through to Friday night. Trade on your phone, tablet, PC or Mac on a wide range of instruments using leverage. Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.