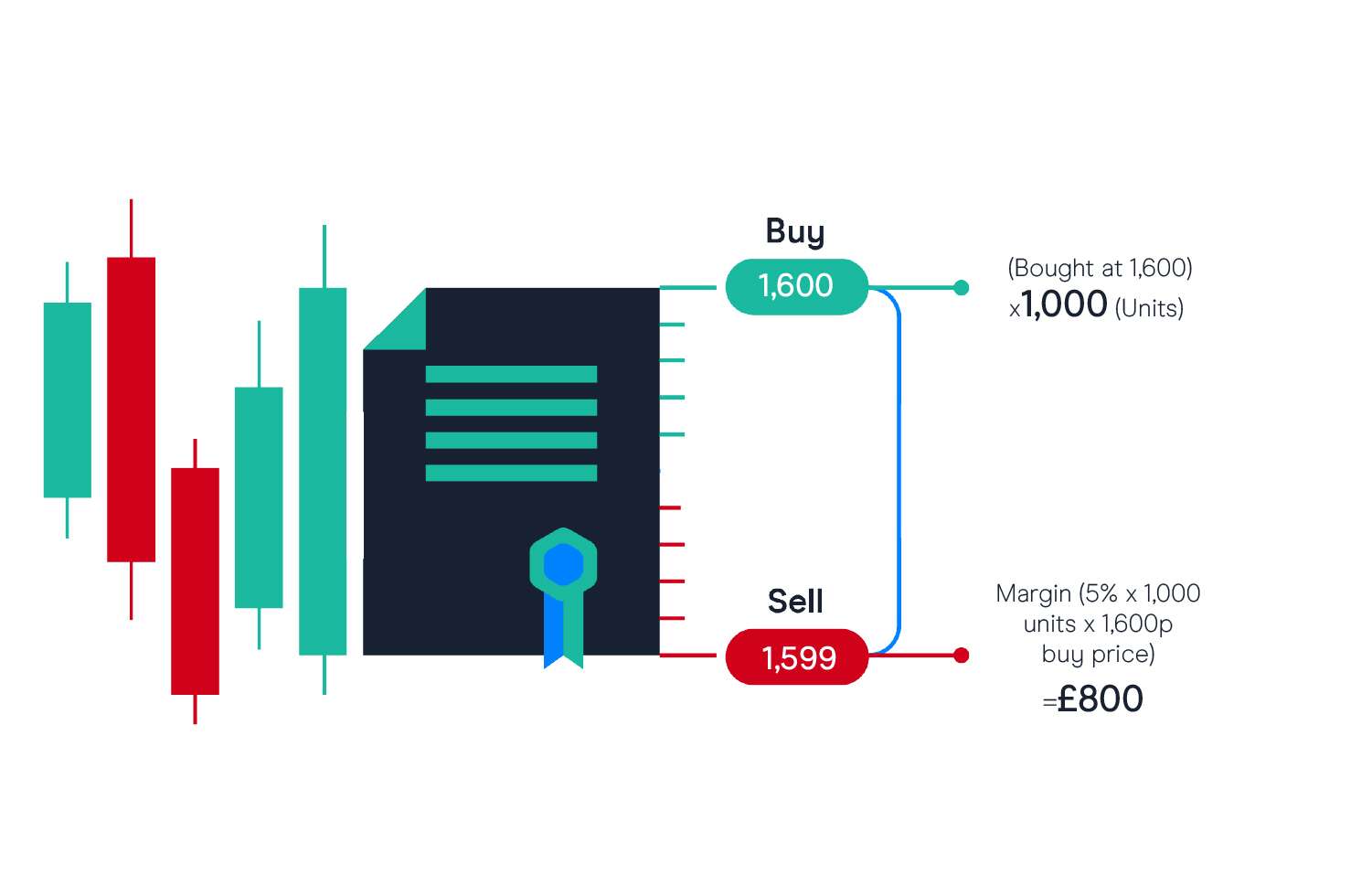

CFD example 1: buying ABC plc

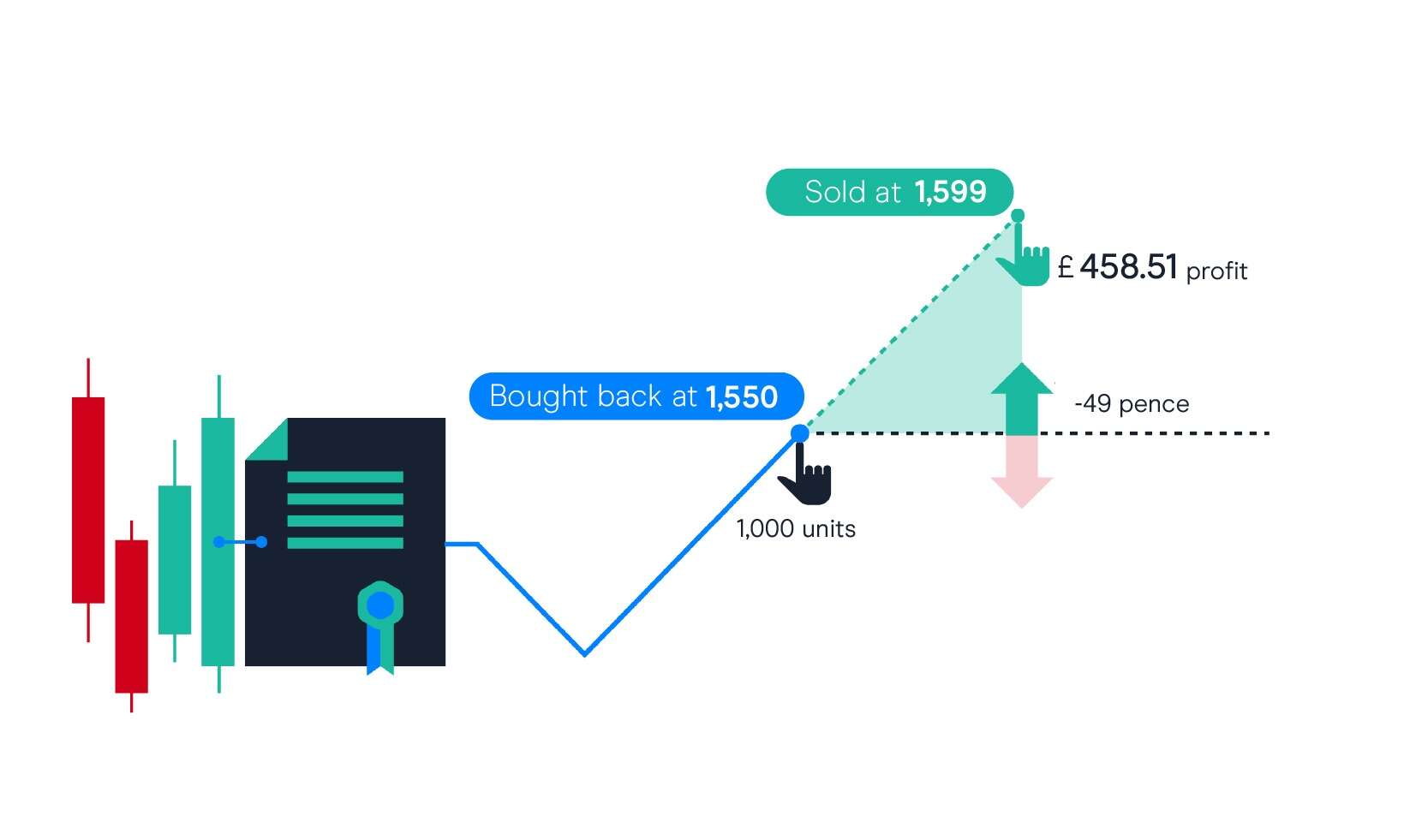

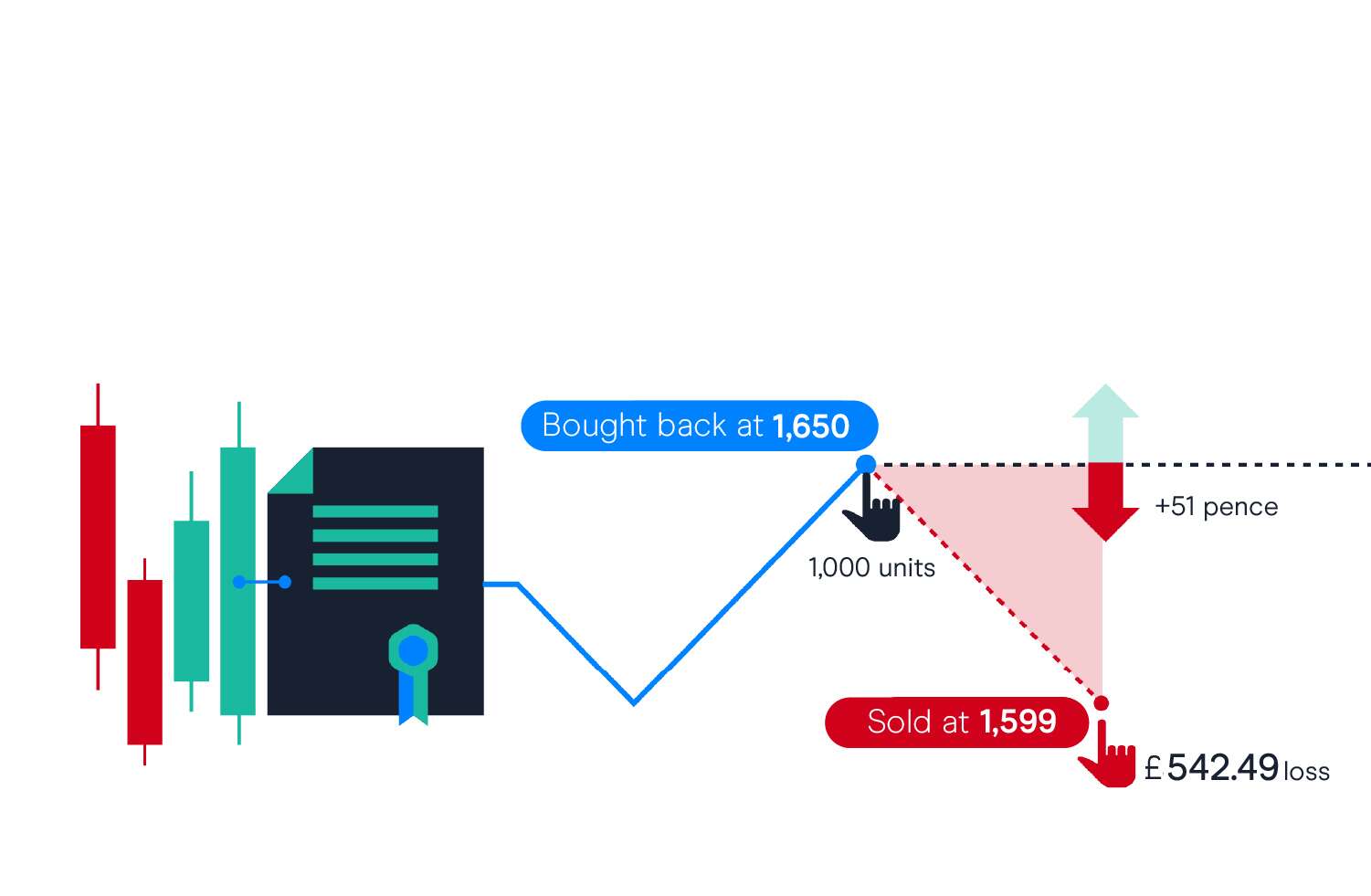

In this CFD example, ABC plc is trading at a sell/buy price of 1,599/1,600p. Assume you want to buy 1,000 share CFDs (units) because you think the price will go up. ABC plc has a tier 1 margin rate of 5%, which means that you only have to deposit 5% of the position’s value as position margin.

In this example, your CFD position margin will be £800 (5% x (1,000 units x 1,600p buy price)). Remember that if the price moves against you, it is possible to lose more than your initial position margin of £800.